Evaluate the view that imposing a tax is the most effective government policy for reducing the market failures arising from over-consumption of unhealthy food and drink (25 Marks)

Plan

- Intro define market failure --> state that gov intervention is necessary. the best gov intervention solves the market failure and less chance of gov failure

- Paragraph 1 - Indirect tax

- tax revenue, inelastic

- Paragraph 2 - Minimum price

- excess supply, inelastic (firms are going to profit)

- Paragraph 3 - Provision of info

- ignored, opportunity cost

- Conclusion - risk of government failure - indirect tax

Market failure is a misallocation of resources. This is when goods and services are provided at the wrong price or quantity. This is an argument for governments to intervene in the market.

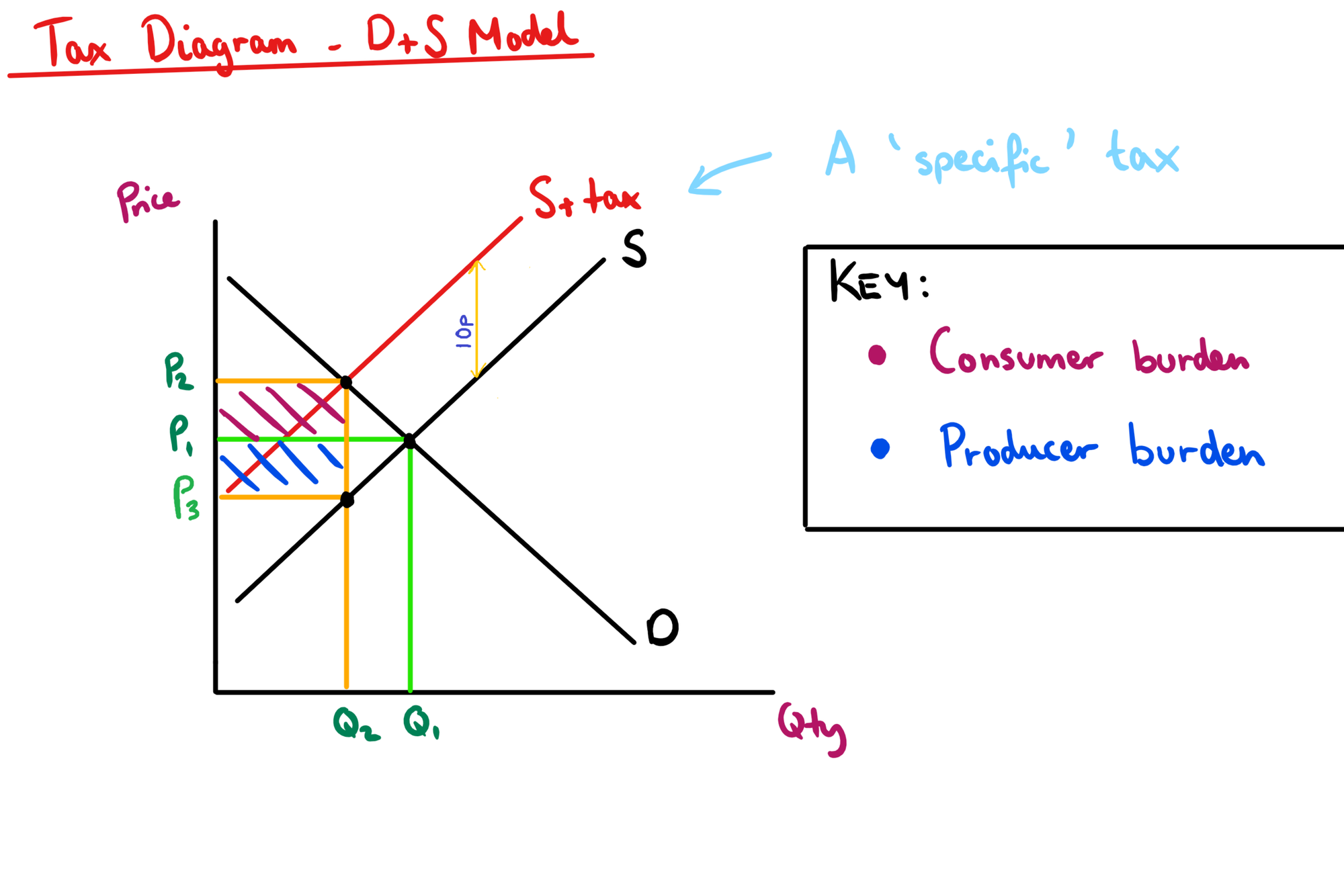

An indirect tax may be the best policy to reduce the market failure with sugary drinks. The type of market failure is negative externalities in consumption because sugary drinks are a demerit good. Therefore they are over consumed. A tax is a cost of production that causes supply to shift to the left. This can be used to reduce the overconsumption. For example, the diagram below shows quantity falling from Q1 to Q2 and price rising from P1 to P2.

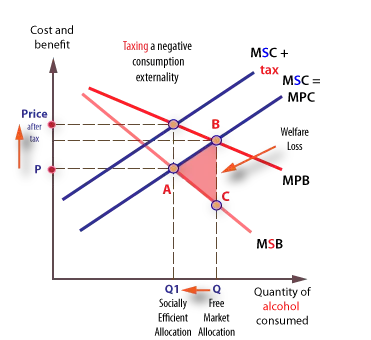

This can be shown to reduce the size of the externality. The free market would have an equilibirum at the point where MPC = MPB. When transacting, the buyer and the seller did not consider the negative impacts of consuming sugary drinks on third parties, for example a larger strain on the NHS. The socially optimal quantity is where MSC = MSB. This means we were overconsuming so the tax would shift MPC to the left and bring the market closer to Q*.

Overall, a tax would be effective in reducing the size of the externality and hence the market failure.

One of the problems with indirect taxes is potential government failure in the form of unintended consequences. Government failure occurs when a government intervention leads to an outcome that is overall worse for society. For example, the tax will aim to reduce the quantity consumed from Q1 to Q*, however if the good is inelastic in demand, then quantity demanded will not fall by enough. This is likely to happen because sugary drinks and unhealthy food are addictive and take up a small proportion of income as they are often quite cheap. Therefore a tax of a sensible percentage is unlikely to deter consumption. On the flip side, if a tax is imposed and quantity demanded is price inelastic then the government will be able to raise a lot more tax revenue from this market, and most of the burden will fall on the unhealthy consumers, as shown within the shaded rectangle below.

This revenue can be used to improve the quality and affordability of healthy substitute goods. A subsidy is a payment that can encourage supply to shfit to the right as it lowers costs of production and may allow greater spending to improve or advertise the products.

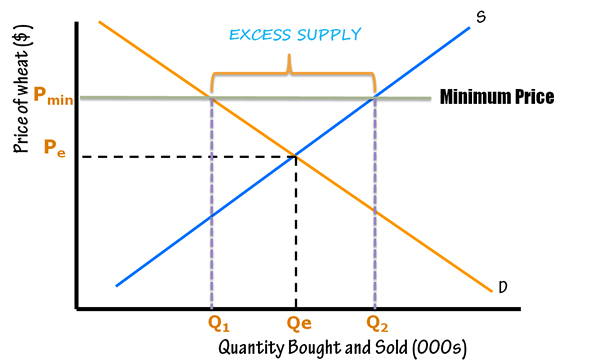

Another government intervention that could be effective to reduce the market failures with unhealthy food and drink could be minimum prices. Minimum price is a price set above the equilibrium price below which it will be illegal to sell. The higher price means that fewer people are willing and able to consume sugary drinks so there is a movement back along the demand curve.

The diagram shows that the minimum price level (Pmin) is set above the equilibrium (Pe) and it causes the quantity demanded to fall from Qe to Q1, which will be closer to the socially optimal quantity that has less negative externalities.

However, if a higher is enforced, producers will want to sell an even higher quantity of Q2 because of the higher profit to be made, however, consumers will only demand a quantity of only Q1. This is good for solving the unhealthy effects because quantity is reduced however there is an excess supply and this may cause firms to get frustrated or lose business and potentially shut down, which can have complicated effects on other markets. For example, the grocery shop may also sell healthy products but the lack of profit to be made on sugary drinks can cause them to close down. Also, yet again, if the good is price inelastic in demand, the higher price will not cause a significant decrease in quantity, and it just means that the seller can profit and exploit this unhealthy, and addictive food even further.

Provision of information may be a better government intervention to solve this market failure. This means providing consumers with information that allows them to understand the negative consequences of consumption on third parties, such as the effect on the taxpayer or the NHS. previously, when consumers bought sugary drinks or unhealthy food they were so you’re thinking about the utility when consuming them however after providing them with the information, they also take into account the negative impact the consumption may have on other people and therefore they gain less utility from it. As a result, the MPB curve shifts lower down and becomes closer to the MSB curve. Rather than using attacks to reduce supply and become closer to the optimal quantity, providing information directly allows the marginal private benefit curve to divert less from the marginal social benefit curve thus reducing the externality and therefore the market failure.

This has proven to work successfuly for example with the Covid campaign campaign, nudging consumers to do what’s best for society as well as themselves. However the main downsides to this market government intervention are that it costs a lot of money and that there is a large opportunity cost where funds could be used for a different purpose such as directly subsidising healthy substitutes, and that it’s not always true that consumers will change their minds based on the information provided. For example, the information could be ignored or consumers could see the information as unethical and convince them even further that they have a free will and can choose things for themselves.

Overall, taxes would be the best government intervention provided that, if quantity is not reduced, the tax revenue should be used to provide subsidies for healthy substitutes, However if that is not going to be the case provision of information may be a better alternative to directly reduce the quantity of overconsumption and bring us closer to the socially optimal quantity with a single government intervention.