Indirect Tax | A-Level Economics Model Paragraph (AQA, Edexcel, OCR)

- indirect tax can be used when there are negative externalities

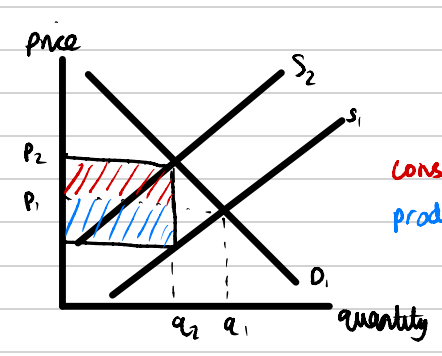

- diagram

- quantity gets reduced

- evaluation

- government failure

- PED

- burden

- tax revenue

An indirect tax is an extra cost of production imposed, causing supply to shift to the left.

The diagram that the supply for fast food has shifted to the left because of the indirect tax that the government have imposed on firms. As a result, the equilibrium price has increased from p1 to p2, and quantity has fallen from q1 to q2. This is good because it will mean that fast food is no longer being over-consumed, which reduces the externalities and the market failure.

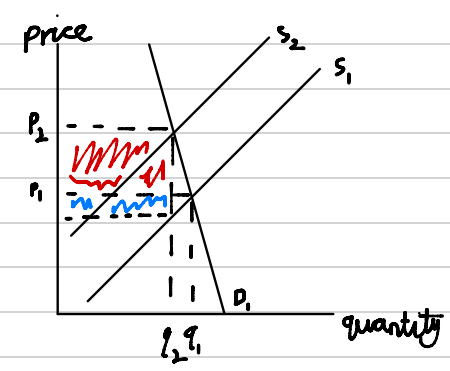

In evaluation, there is a risk of government failure, in the form of information gaps and unintended consequences. For example, the diagram above does not factor in the fact that demand for fast food is likely to be inelastic. This means that there would be a very small decrease in quantity demanded given an increase in price.Fast food may be inelastic because it is somewhat addictive and also it costs a small proportion of income, so people will continue to buy it after the tax causes a rise in price.

This diagam shows that, if demand is inelastic, a left shift in supply from an indirect tax would cause a larger increase in price but only a small decrease in quantity. Therefore, the externalities and the market failure would still remain. Furthermore, the shaded rectangles show that the consumer burden is far higher than the producer burden. Indirect taxes are regressive and the price rise will affect low-income consumers more. Wealthier consumers will not be impacted as much - so the government should find other ways to discourage the consumption of fast food. One positive is that the rectangle shows the tax revenue generated by the government from the indirect tax. This can be used on other government interventions or public services, such as subsidised healthy food or gyms or leisure centres.