Privatisation | AQA A-Level Economics Model Essay

PLAN:

is privatisation good or bad

Intro: define privatisation, nationalisation - we can figure out if this is a good or bad idea based on what market structure it is/ would be - natural monopolies, market failure?

😄 - monopolistic competition diagram, more incentives (profit), dynamic efficiency?, productive efficiency? CONTESTABILITY.

😦 - NATURAL MONOPOLY DIAGRAM, oligopoly, nationalisation is better if privatisation leads to monopoly power, exploiting customers, allocative inefficiency, natural monopoly.

Use the extracts and your knowledge of economics to assess whether the benefits outweigh the costs when the Government privatises organisations such as Royal Mail and opens up the market to competition. (June 2017)

Privatisation is when the government sell a business to a privately owned firm. The outcome can be good or bad depending on what market structure the firm would join into, outcomes such as price and quantity, efficiencies (allocative and dynamic) and the risk of market failures.

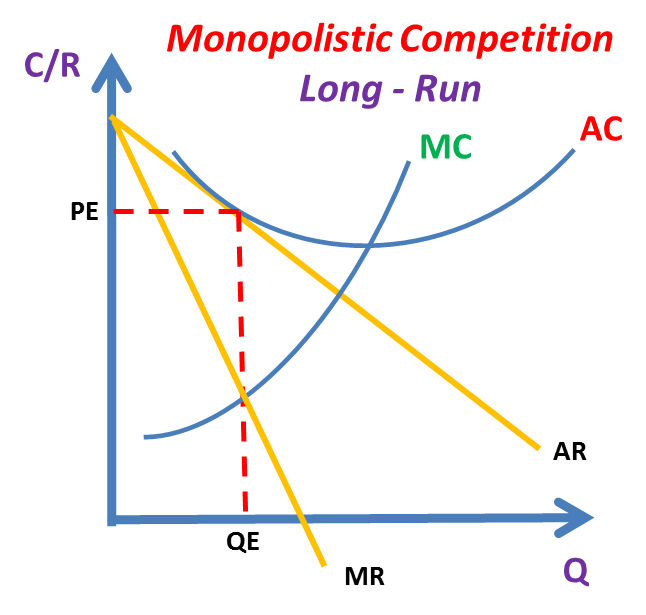

Privatisation can be good, especially in this case, as the market for delivery companies could be a monopolistically competitive one. This is when there is slight product differentiation, and low barriers to entry. There is slight product differentiation in the sense that competitors such as Royal Mail and DPD offer similar services with their own differences, such as delivery time and customer services. If a market has monopolistic competition, the outcome would look like this in the long run.

This outcome leads to a quantity of QE and a price of PE in the long run. The firms make no supernormal profit but this is good because they are able to make supernormal profit in the short run. Existing firms can innovate and increase demand. If this happened, then new firms would join so each firm would face lower demand again and supernormal profits would vanish. This type of market is contestable. This is when there is hit and run competition, keeping firms on their toes, and keeping prices low so consumers don't get exploited.

In evaluation, it is not necessary that barriers to entry are very low. For example, in 2015 Royal Mail had 32.8% market share so it would be realistic that they would have monopoly power if privatised. It is essential that the government ensure barriers to entry would be low if the Royal Mail was privatised to benefit from contestability and low prices.

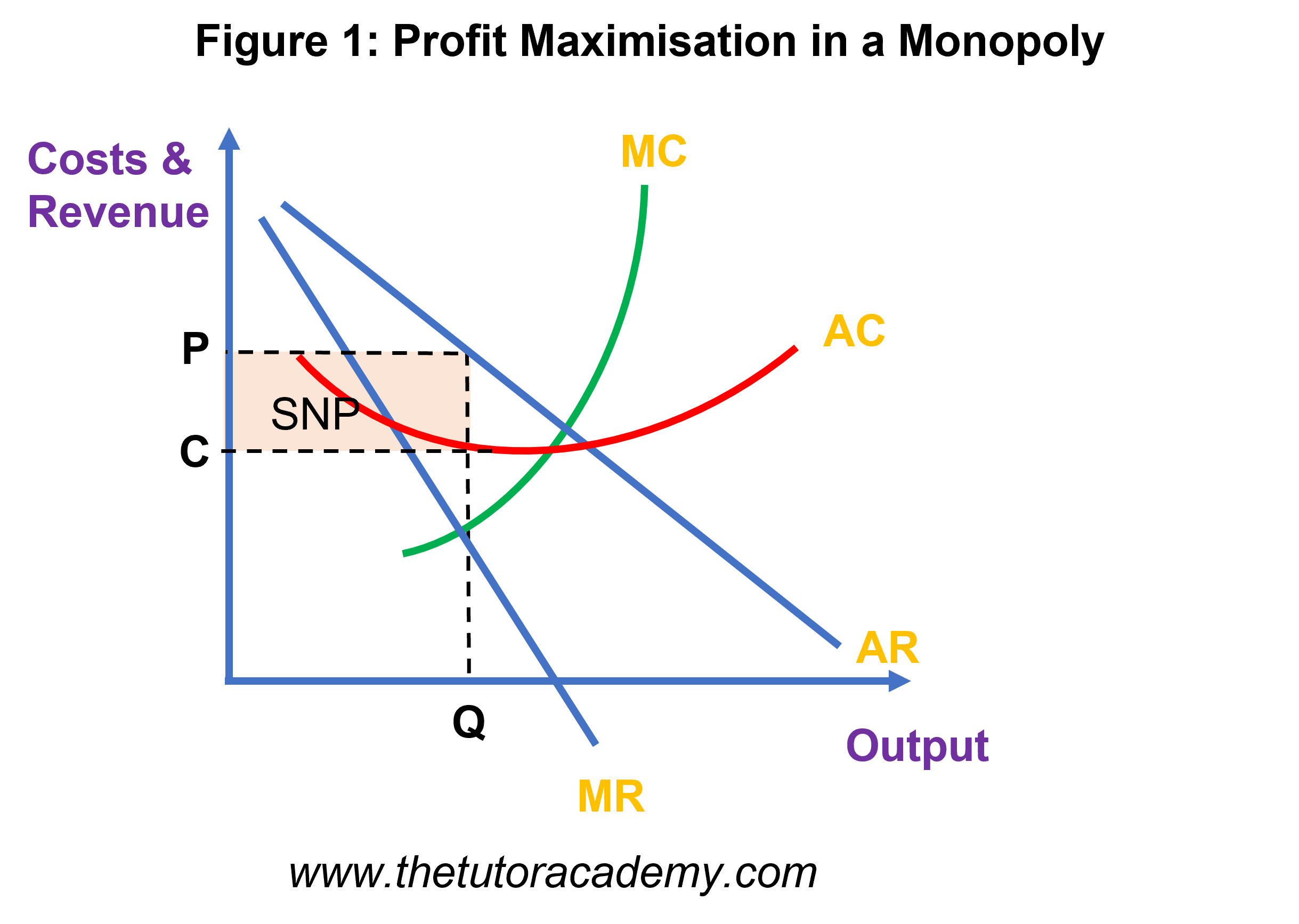

On the other hand, privatisation has some disadvantages. With the risk that Royal Mail had monopoly power if privatised, we would have to consider the benefits and costs of this too. With monopoly power, firms often set high prices and sell low quantities in order to profit maximise. Profit maximisation happens when a firm sells at the quantity where MC = MR, leading to a price of P and a quantity of Q in the diagram below.

This outcome is not allocatively efficient as this only happens when firms are at the quantity when MC = AR. Royal Mail would be exploiting its monopoly power and selling at the quantity Q which is too low. For this reason, it might be better if the government continued to own the Royal Mail. It is also likely that Royal Mail may be somewhat of a natural monopoly. This is when it is most efficient to be one firm controlling a market due to high barriers to entry (high start up costs) and economies of scale that outweigh diseconomies of scale for an extemely high quantity of output.

The diagram above shows this outcome which also results in very high profit for the natural monopoly. If this was the case, it may be beneficial for the government to own the firm as they are more likely to lower prices instead of overcharging customers.

In evaluation, monopolies can be good for consumers as well. This is because supernormal profit in the long run can lead to dynamic efficiency if firms re-invest their profits. This is not guaranteed but could be likely if the firm has incentive to gain market share as it is not a pure monopoly and faces competition from DPD and other firms. Also, the government may not be able to set low prices as they would suffer from a lack of profit motive and inefficiencies as they have so many different priorities. If managing Royal Mail leads to low profits or a loss for the government, this could raise the tax bill too which is an example of negative externalities.

In conclusion, privatisation of the Royal Mail would be a good idea but only if the government is sure that the firm would not exploit its monopoly power. It can do this by ensuring that barriers to entry are sufficiently low to allow for monopolistic competition and contestability. If this does not happen, the firm would have monopoly power. This could also be good as profit can often lead to innovation but there is always the risk that they do not re-invest in their product.