Evaluate the extent to which individuals and firms in the UK benefit from membership of the EU (25 Marks)

Plan

- Intro: describe a trade union e.g. EU, describe the macroeconomic objectives in the UK

- Paragraph 1: no protectionism or retaliation inside the EU

- Evaluation of Paragraph 1: less consumer spending (domestically)

- Paragraph 2:

- Evaluation of Paragraph 2:

- Judgement:

The EU is a customs union. This means the members benefit from free trade amongst other things, and countries that are not part of the customs union may face protectionism when importing from EU countries. Therefore, membership can affect the macroeconomic objectives which are price stability, low unemployment, economic growth, and a balance of payments on the current account.

One of the main advantages of the UK being inside the EU is that the UK will no longer face protectionism when importing from EU member countries.

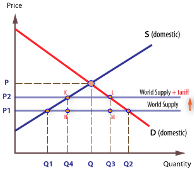

One of the most common forms of protectionism from the EU is a tariff, which is a tax on imports. When a tariff is removed, the world supply curve shifts to the right (down) because the costs of production on the EU supply are reduced. Also, world supply (in this case representing EU supply) is perfectly elastic because there is such a large number of firms in the world compared to just the UK. If this happens, the UK will be able to import a higher amount at a cheaper price. The quantity of imports changes from Q4Q3 to Q1Q2. This means that the UK are able to afford more raw materials and goods at the same price and this could help with quality of life and living standards for consumers as well as lower costs of production for firms. If consumers can benefit from cheaper goods and services, such as chocolate, or holiday packages, then it may lead to higher disposable incomes and this may lead to greater consumer confidence and higher aggregate demand. Meanwhile, if firms are able to benefit from the lower cost of imports, which could be for raw materials or factors of production including labour, then SRAS (total planned output) will shift to the right and the UK will be able to produce more at every price levels. If AD and SRAS shift to the right for those reasons (greater consumer confidence and lower costs for firms), this would lead to a greater output, lower unemployment rate, greater economic growth, and a stable price level, as seen in the diagram below with an increase in output from y1 to y2, and a constant price level of PL1.

DIAGRAM OF SRAS RIGHT AND AD RIGHT

I would evaluate this by arguing that the tariffs diagram and theory does not support the logic that the removal of a tariff will lead to an increase in AD. If a tariff is imposed, UK consumers would buy goods domestically up to q1, which is less than q4, and import more. Since AD = C + I + G + (X-M), then M would go up and X would go down, meaning that AD would also go down ceteris paribus. Our argument strongly depends on how UK consumers react to cheaper imports, and whether it means more savings which can be spent on domestic goods and services, such. as restaurants and leisure or just a higher quantity of imports.

On the other hand, removing tariffs and being part of the EU can potentially damage the UK economy. From the initial diagram, domestic consumption reduced from Q4 to Q1, while imports increased from Q3Q4 to Q1Q2. If UK consumers are not buying from UK firms, then aggregate demand in the UK is lower. AD is the total planned spending in the UK. If this is lower, we would see a left shift in AD and firms would be producing less output because EU firms are more competitive, so they may lay off workers. This has many implications for the UK macroeconomy. Higher rates of unemployment will lead to an even further decrease in AD, which overall can lead to a lower GDP from y1 to y2, and a lower price level from PL1 to PL2. Unemployment and possible deflation are characteristics of an economic downturn or possibly a recession. This is difficult to manage because it would either require retaliation in the form of our own tariffs or leaving the EU, or improving the UK supply side which can improve the UK's supply to make it as high quality and cheap as EU supply, but bears a huge opportunity cost and time lag. Also, the increase in imports and lower exports will lead to a worsening of the current account deficit, which is bad because it could lead to over-reliance on imports, which can discourage UK firms, and leave us vulnerable to exchange rate shocks.

In evaluation, free trade allows countries to take advantage of their comparative advantage which means over time, the UK will be able to find goods and services that they can specialise better in and hence compete with, and work with the EU countries to produce more total output, despite the short run negative supply side shock. Also, leaving the EU recently has potentially been a factor leading to cost push inflation, because although the UK face tariffs when importing from EU countries now, that has not led to a switch to buy some things domestically. Certain goods and services are still being bought from the EU so therefore it may be better to be a member where there are no tariffs.

In conclusion, the benefits and costs of EU membership depend mainly on time and elasticity of imports and exports. In the short run, the UK would suffer from EU membership because UK firms would lose out, however over time they will become more competitive.