Economic Growth & Inflation | 4.2.3 | AQA A-Level Economics Notes

4.2.3.1 Economic Growth and the Economic Cycle

• Economic growth is the rate of increase in the potential output of an economy.

• Short-run economic growth occurs when an increase in aggregate demand brings spare capacity into production.

• Long-run economic growth occurs when the productive capacity of the economy increases. It is used to refer to the trend rate of growth of real national output in an economy over time.

• Factors that will cause an outward shift in AD or SRAS are causes of short-run economic growth.

• Factors that are able to cause a rightward shift in LRAS will mean there is long-run economic growth.

• Economic growth can lead to higher wages and more spending, the government are also able to collect more tax revenue.

• On the other hand, economic growth can lead to inflation if it is not managed, as well as a current account deficit, and environmental problems.

• The economic cycle shows the stages of economic growth a country is in. These stages include boom, downturn, recession and recovery.

• An output gap is the different between the actual, current level of real GDP and the output at the trend rate of growth in the economy (potential output).

• A positive output gap occurs when real GDP is above the productive potential of the economy, and a negative output gap occurs when real GDP is below the economy’s productive potential.

• Cyclical instability is caused by excessive growth in credit, debt levels, asset price bubbles, destabilising speculation, and animal spirits or herding.

4.2.3.2 Employment and Unemployment

• The main UK measures of unemployment are the claimant count and the Labour Force Survey measure.

• Voluntary unemployment occurs when someone chooses not to work at the current wage rate.

• Involuntary unemployment occurs when someone is willing and able to work at the current wage rate, but cannot find work. There is an excess supply of labour.

• Structural unemployment occurs when there is a decline in demand for goods and services in a particular industry.

• Seasonal unemployment occurs during particular times or seasons.

• Cyclical/ demand-deficient unemployment is caused by a lack of aggregate demand in an economy, during a recession.

• Real-wage unemployment occurs when wages are above the market clearing wage-rate, causing excess supply of labour.

• Full employment occurs when the number of people wishing to work equals the number of workers whom employers wish to hire in an economy.

• The natural rate of unemployment is the rate of unemployment when the aggregate labour market is in equilibrium, so the demand for labour equals the supply of labour. This means that all unemployment in the economy is voluntary.

• Cyclical unemployment is linked to a negative output gap.

• Unemployment has a variety of causes and hence the appropriate policies to reduce unemployment depend on the cause.

• Changes in the rest of the world can affect domestic employment levels. For example, globalisation has allowed production to move to countries with lower production costs, causing structural unemployment. At the same time, immigration of working-age people and skilled workers increase productivity and global competitiveness, but causes youth unemployment.

• Unemployment can lead to smaller disposable incomes, worse living standards, government spending on welfare, and negative externalities such as crime.

4.2.3.3 Inflation and Deflation

(Quantity Theory, Fisher Equation is Year 13 Only)

• Inflation is a rise in average price level.

• Deflation is a fall in average price level.

• Disinflation is a fall in the rate of inflation, above 0%.

• Demand-pull inflation is caused by an increase in aggregate demand.

• Cost-push inflation is caused by an increase in costs of production or a decrease in short-run aggregate supply.

• The Quantity Theory of Money is an argument that only changes in the money supply will cause inflation in an economy. This is believed to be true by monetarists.

• The Fisher Equation suggests that MV = PQ, where the M is the money supply, V is the velocity of circulation of money (no. of times it changes hands), P is the average price level, Q is the real GDP.

• As a result, the left hand side of the equation (MV) shows what is brought in the economy, and the right hand side shows what is sold. Both sides of the equation are equal to the nominal GDP in the economy.

• The inflation rate, P = MV/ Q. Monetarists believe that V/ Q is constant, and therefore the money supply is the determining factor. More money chasing the same number of goods and services will cause price rises. (V is argued to be constant because the number of times workers are paid hardly changes. Also in the LR, Q is constant as real GDP).

• Expectations of inflation can cause increases in demand immediately, and this will subsequently cause further inflation.

• Expectations of deflation can lead to a decrease in demand and this is very dangerous for an economy, as it can lead to fall in consumer confidence and spending. This can affect business confidence and leads to a fall in wages. Deflation is difficult to come out of as real interest rate values increase.

• Inflation can affect consumers on low incomes, but can lead to firms paying higher wages, more disposable income and further consumption.

• Supply-side deflation is good for the economy.

• World commodity price rises can lead to cost-push inflation in the UK.

• Changes in other countries can affect UK inflation. For example, economic growth in manufacturing countries can lead to inflation, and this will lead to cost-push inflation for the UK.

4.2.3.4 Possible Conflicts between Macroeconomic Policy Objectives

(Phillips Curve is Year 13 Only)

• Short-run economic growth beyond the trend growth rate means a positive output gap exists, leading to inflationary pressure.

• Short-run economic growth can also mean there will be a fall in unemployment rate, as spare resources are being used.

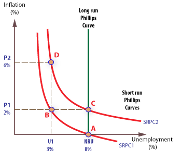

• The short-run Phillips curve is l-shaped. It shows that when unemployment is low, workers are scarce so wages are high, as the labour force has bargaining power. This leads to more spending and therefore inflation.

• When there is a shift in AD, we move along the SRPC.

• When there is a shift in SRAS, there will also be a shift in the SRPC.

• The L-shaped Philips curve is also known as the vertical long-run Phillips curve. It shows that the economy will always return the natural rate of unemployment in the long run. There is no trade-off between I and U.

• The monetarist and supply-side view argues that major macroeconomic objectives are compatible in the long run.