Use the extracts and your knowledge of economics to assess the view that housing markets should be left to market forces with only the minimum of intervention from governments. (June 2016)

Plan

- Intro

- P1 - yes the housing market should be left to market forces

- the price mechanism solves the problem of excess demand

- excess demand diagram

- evaluation - only limited to solving the basic economic problem - some are not willing and able to buy a house

- P2 - no the housing market needs intervention

- the free market does not account for externalities

- externality diagram

- government intervention could solve the problem

- state provision/ subsidies/ max price

- evaluation - gov failure

- Judgement

Market failure is when there is a misallocation of resources. The housing market may have a market failure, and if so, the government need to intervene to solve this. However, government intervention can also lead to government failure.

Arguably, the housing market should be left to the free market. Line 5 mentioned that there is an issue of 'excess demand' in the housing market. This could be solved by the price mechanism, which has the functionality to ration, signal, and incentivise. For example, if there is an increase in population, there would be an increase in the demand for housing. Extract B, line 2 mentioned 'rising immigration' and more one-person households.

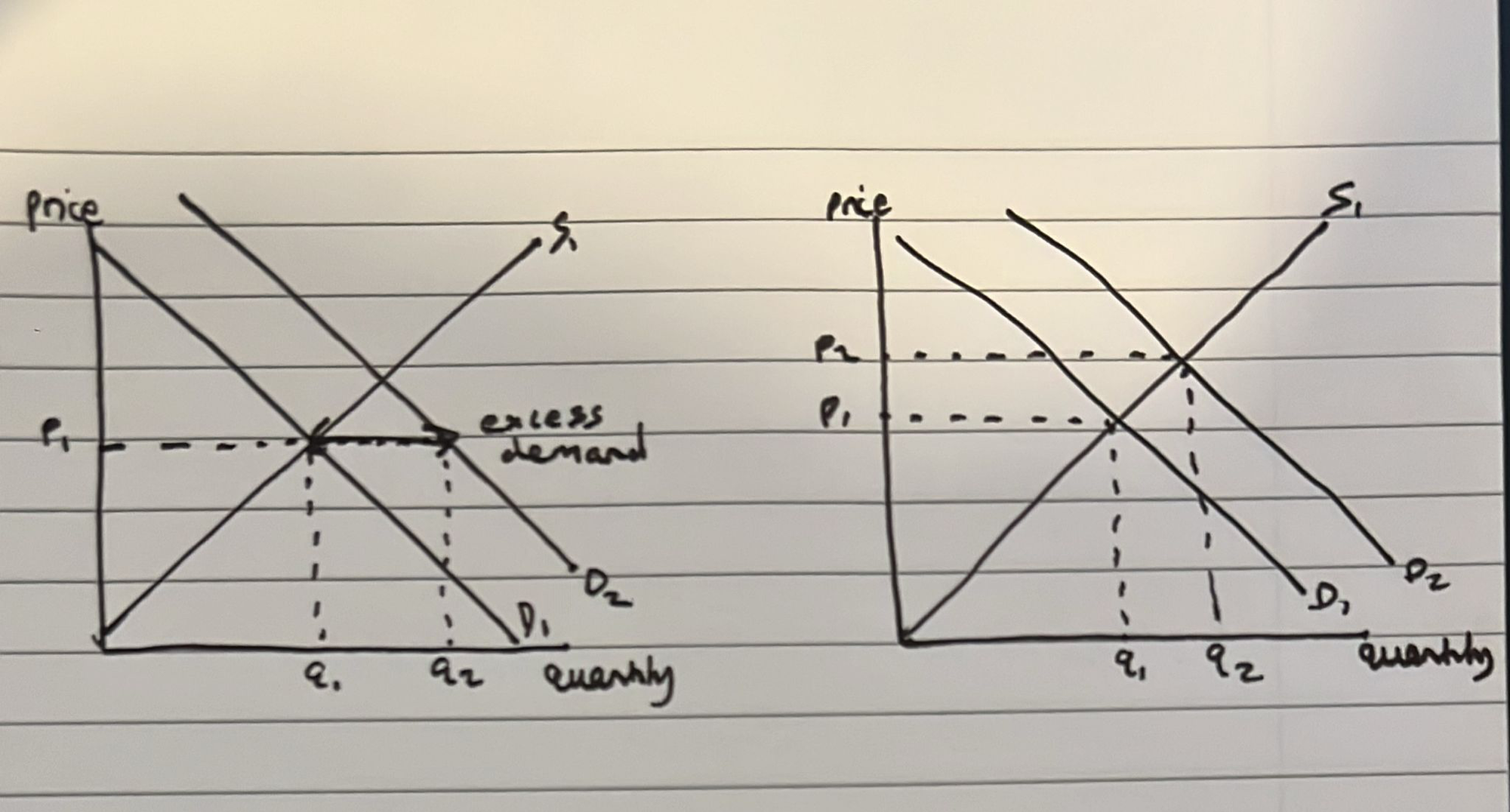

The diagram below shows the impact of this on the housing market.

The first diagram shows that, if there is a right shift in demand, there would be very high number of houses (q2) that people are willing and able to buy at p1, but a low number of houses (q1) that firms are willing and able to sell at p1. The gap between q1 and q2 is the excess demand. The market will adjust prices higher and higher until there is a new equilibrium, as shown by the second diagram - at q2 with a price of p2. This is known as the rationing function of the market - higher prices rationed away the excess demand - so houses are bought and sold only by those who are willing and able. The high price also provides a greater profit motive, and this incentivises firms to increase the number of houses available for sale. Hence, there is a higher equilibrium quantity of q2. This is also known as the invisible hand of the market. There is also no risk of government failure.

However, while this does solve the issue of exccess demand, the issue remains that some people will still be left homeless. The price mechanism is capable of solving the basic economic problem (unlimited wants, limited resources), but it does this by allocating goods and services based on willingness and ability to buy or sell. This means that whoever is unable to afford a house, would remain homeless. It would require government intervention to solve this problem.

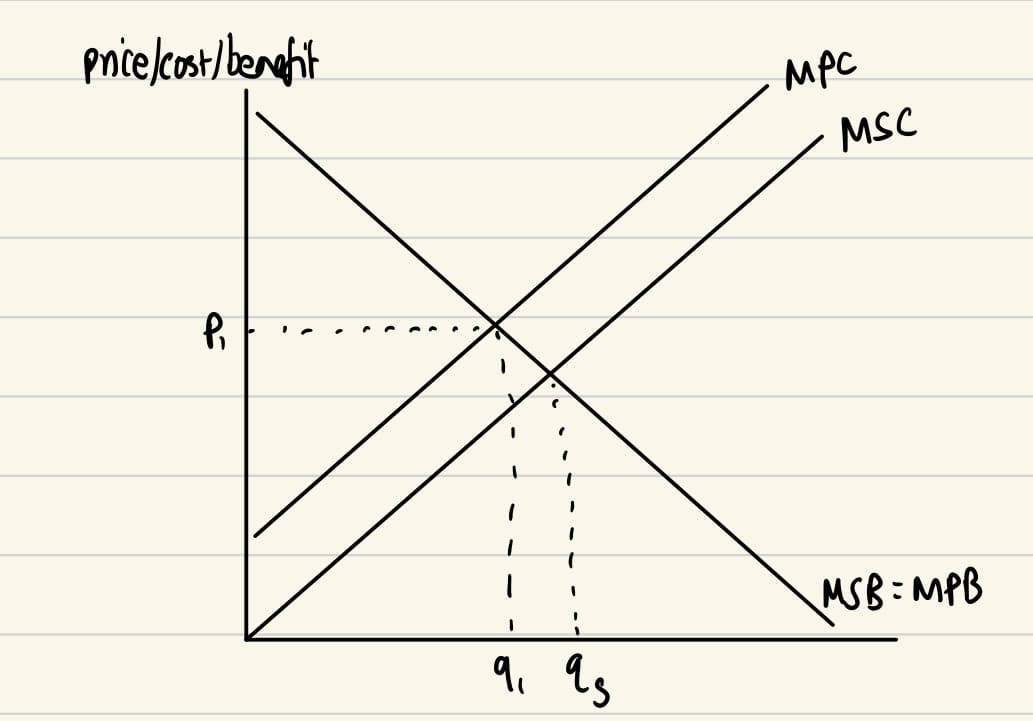

On the other hand, some may argue that the government intervention is necessary in the housing market. Without any government intervention, there is arguably a clear market failure which cannot be solved by market forces. The market failure is caused because housing has positive externalities in production. This means that the supply of houses has a benefit to a third party - meaning someone other than the buyer or the seller. For example, when extra homes are supplied on the market, there would be a positive impact on a neighbourhood because there will be a decrease in the number of people who are homeless. However, producers only consider the profit as a reason to supply houses, which means that the externalities get ignored in the free market. The diagram below shows this outcome.

The equilibrium quantity for housing is at q1, where MPC meets MPB. However, the socially optimal quantity is qs, which is where MSC meets MSB. This quantity qs factors in the positive externalities in the provision of housing. This problem could be better solved through government intervention. One example of this could be in the form of provision of information. The government could start an advertising campaign, which would share the benefits of building new homes or putting more homes on sale.

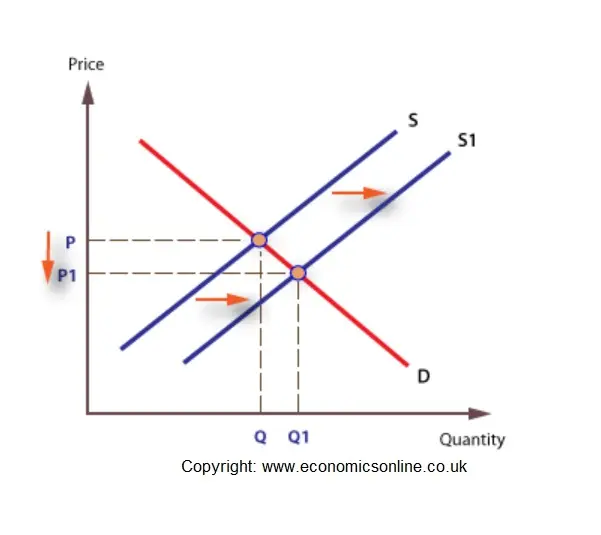

The information should encourage an increase in the supply of houses, which would lead to a fall in price from p to p1 and an increase in the equilibrium quantity from q to q1, which should mean that the market failure is solved, as we are closer to qs (socially optimal quantity).

However, with each style of government intervention, there would be a chance of government failure, which is where the misallocation of resources remains or worsens. With information provision, the government would face an opportunity cost from spending money booking advertising slots on the TV or on notice boards, or when delivering leaflets. They should be certain that the government intervention is important enough to spend money to solve. The extract mentioned that homelessness costs the government arounr £1 billion a year. Secondly, there is also an opportunity cost in the sense that the government could have spent the money differently, or used a more effective form of government intervention, such as rent controls, or spending money subsidising housing or directly increasing the quantity of houses that are state provided.

Overall, the free market is capable of solving basic economic problems but we cannot depend on it due to the nature of housing as a merit good and as a necessity. It is important that the government intervene with the method of intervention which has the least risk of government failure.