Oligopolies | AQA A-Level Economics Model Essay

Evaluate the view that the supermarket sector is serving customers' interests well. (June 2022)

Plan

- Intro: oligopolies can be collusive or competitive and usually competitve oligopolies would serve customers well.

- Point 1: game theory, possibility of largest firms colluding, monopoly outcomes

- Evaluation: unlikely in supermarket sector due to CMA

- Point 2: competition oligopoly, kinked demand curve, non-price competition

- Evaluation: lack of dynamic efficiency for some firms, lack of contestability

- Judgement: it is serving customers well but we should monitor to prevent any collusion

Oligopolies are market structures with a few firms. Oligopolies sometimes serve customers well but this significantly depends on the type of oligopoly and the behaviour of firms in the market. They can be collusive or competitive.

Collusive oligopolies can form if firms with a high market share secretly agree to limit quantity and set high prices. They do this because they know the benefit of working together. Game theory is the study of how outcomes of an agent are dependent on the behaviour of themselves as well as another agent. For example, Prisoner’s Dilemma shows that two people would end up with shorter prison sentences if they were able to talk and decide to both deny a crime, but if they had to make decisions individually they would end up confessing and this would lead to a higher sentence for each. The table below shows this.

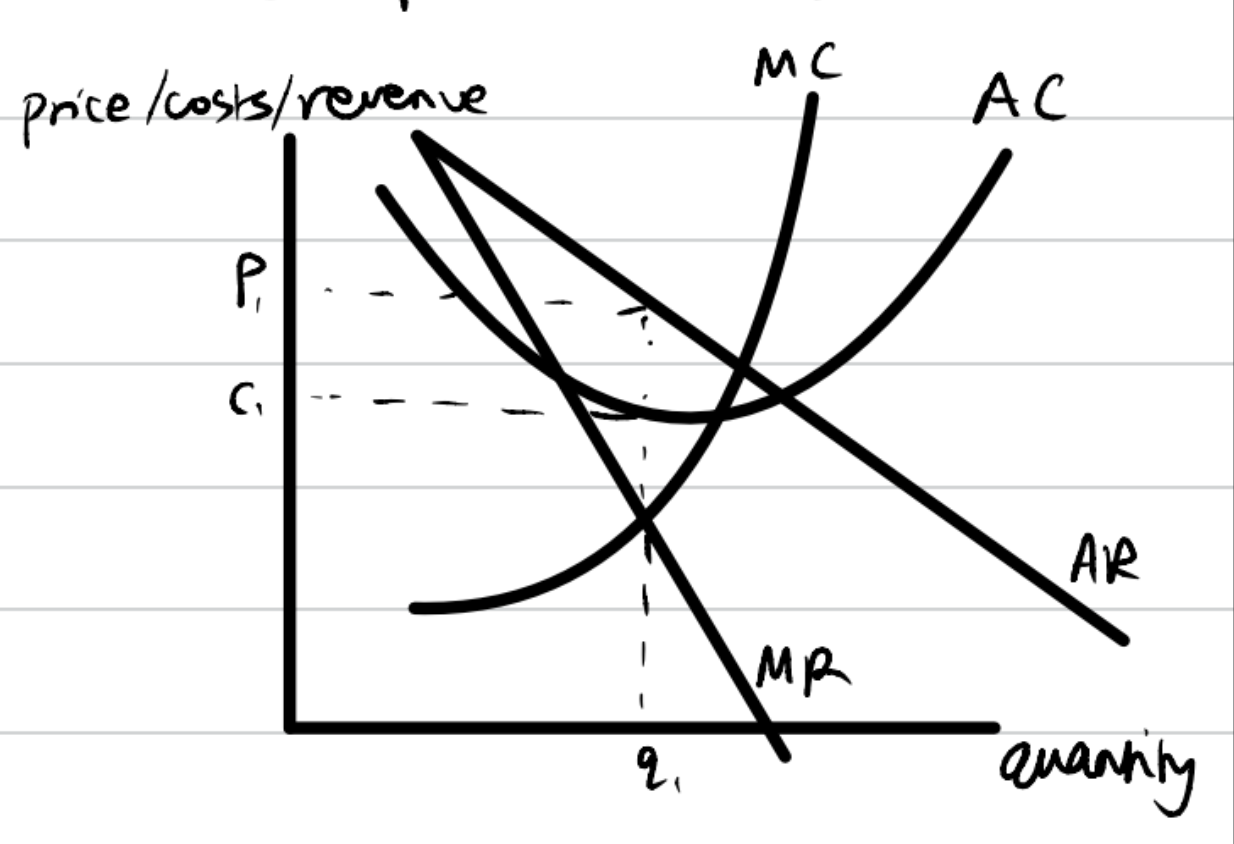

In the supermarket sector, the largest firms could collude to set high prices (p1) and low output (q1) of some products, and this would lead to an outcome as though they were one large firm with monopoly power. The diagram below shows this.

The firms, which act as one firm, profit maximises and sets prices and quantity following the point MC = MR. Extract F described that the second and third largest supermarkets attempted a merger, which would have given them signficant monopoly power, alongside Tesco, compared to any other supermarket.

In evaluation, this is not necessarily a likely outcome in the majority of oligopolies, as there would have to be a low number of firms, imperfect information, high barriers to entry, and poor regulation, for this to be possible. Some oligopolies, such as OPEC prove that collusion does lead to poor outcomes for consumers, such as high prices and low output but this may not be the case in the supermarket sector. It is still important to monitor this because if regulation was poor, firms may have the temptation to collude. Furthermore, there is a possibility that some of these firms have local monopolies due to the barriers to entry such as high start up costs required to create a large supermarket. Therefore, firms in an oligopoly may price discriminate based on location, or set high prices in a location due to their local monopoly power.

Furthermore, even if firms could collude, there is arguably the benefit that they could use the high profits for investment and this would lead to innovations and quality products in the long run. This is called dynamic efficiency and this would benefit consumers over time. For example, pharmaceutical companies make a lot of profit but this also enabled them to quickly create innovative products, including the Covid vaccine at a very fast rate.

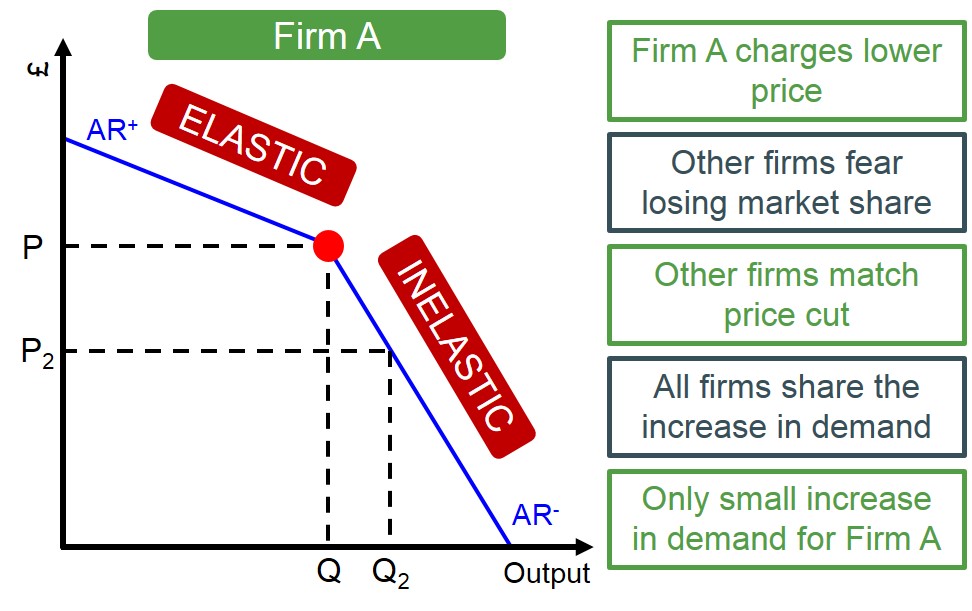

A second point is that oligopolies would generally lead to good outcomes for consumers if they are competitive. The supermarket sector is quite likely to be competitive because of EU competition law as well as competition authorities in the UK, such as the CMA (Competition and Markets Authority) usually investigate potential mergers and prevent them if they lead to a firm having too much monopoly power. For example, the CMA prevented Sainsbury's and Asda from merging in 2019 (Extract C). With these factors in place, firms would end up being in a competitive oligopoly. Firms here are unable to compete on price. If they raised prices, customers would buy from competitors instead and if they lowered prices, competitors would reduce their prices too so prices end up being stable. The Kinked Demand below shows this.

Hence, firms would try to increase their market share by competing on things other than price. This non-price competition allows customers to benefit from great variety and quality of customer service, recipes, taste, quality, and special offers from each supermarket. Depending on prices, firms may also make enough profit to re-invest which would lead to dynamic efficiency and greater improvements in products over time through innovation. So, overall competitive oligopolies can be hugely beneficial for consumers.

On the other hand, oligopolies can greatly vary from one to another so factors such as concentration ratio and market share can make a big difference. For example, the theory of the Kinked Demand curve and price rigidity may not hold in real life because some firms may have some price making power due to brand loyalty, or also in the case of local monopolies. For example. Burger King at an airport or a petrol station on a motorway would be one of the only firms of its kind in the area. Therefore, in that particular branch, they have the ability to set higher prices and exploit customers. So, theories about oligopolies are not always fully consistent with markets in the real world.

In conclusion, I would say that the supermarket sector is currently serving customers well because of the non-price competition leading to great variety in branding, and good customer service at each of the supermarkets. However, it is important to continue to monitor the supermarket sector to prevent any potentially large mergers, as signifgicant monopoly power could lead to higher prices for customers.