Edexcel A-Level Economics 25 Marker | Externalities

The International Energy Agency has predicted that oil use by cars will peak in 2025 because of the increasing number of drivers switching to electric vehicles.

Evaluate the likely microeconomic consequences of consumers shifting from vehicles powered by fuel obtained from oil to electric-powered vehicles.

Plan:

- Intro

- Paragraph 1: fuel vehicles have negative externalities in consumption

- Evaluation of P1: electric vehicles also have externalities and lower private benefit/ more inconvenience.

- Paragraph 2: electric car market will only have a few firms with large market share (monopoly power)

- Evaluation of P2: monopoly power is good due to dynamic efficiency, but prices may be high. are there barriers to entry? forces of supply and demand incentivise fuel car companies to start creating electric cars e.g. Porsche now creating the fastest electric car.

- Judgement

Fuel vehicles can be considered as a demerit good because they have negative externalities in consumption. Negative externalities are costs from a transaction that affect a third party (someone except the buyer or seller). This is an example of a market failure, as there is a misallocation of resources.

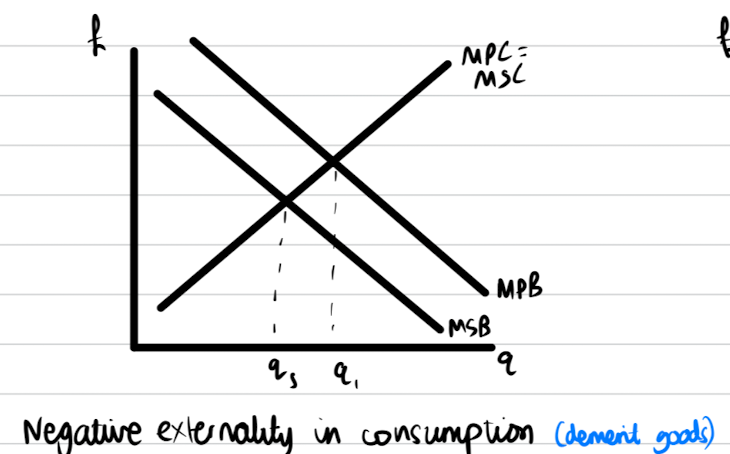

One impact of consumers buying less fuel vehicles and more electric vehicles is that consumption of fuel vehicles decreases. This works because fuel and electric vehicles are relatively close substitutes. This also means that they have a positive cross elasticity of demand (XED) so an increase in supply and a decrease in price of electric vehicles may have caused this. If this happens, it means that the quantity of fuel vehicles consumed will decrease. At the previous free market equilibrium, fuel vehicles were over-consumed because the buyer and seller would ignore the negative externalities on third parties. For example, fuel vehicles cause pollution which can harm the long term health of people and consumption of fuel increases the risk of running out of fossil fuels, which is currently the most reliable source of energy. The diagram below shows the over-consumption at q1, and shows that the social optimal quantity is lower, at qs.

This can always be worked out by seeing where marginal social benefit = marginal social cost, as supposed to where marginal private benefit = marginal private cost. The difference is caused by the marginal external costs being ignored by the buyers and sellers, as they only thought about it the utility the fuel car would give to them.

However, consumers switching to electric vehicles would have also have some negative externalities in consumption. For example, electric vehicles also rely on the use of fossil fuels so this can still cause harm to the environment. Also, electric vehicles require charging points and this can look unpleasant as there would be many charging ports and wires around the country. Also, electric vehicles have a smaller range and take much longer to charge so this could cause congestion and lower productivity.

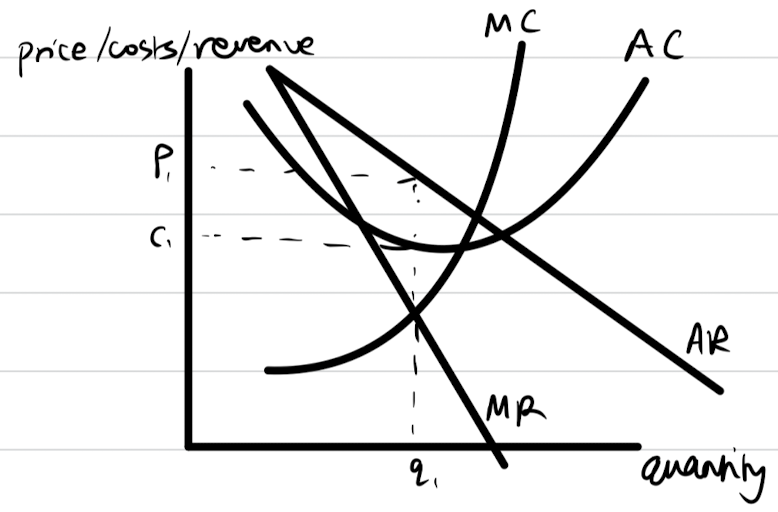

Another impact of consumer demand for fuel vehicles peaking is that when the demand starts to fall, consumers would see electric vehicles as a close substitute and increase demand for them. As the market for electric vehicles wasn't popular until recently, there are only a few firms such as Tesla and Toyota who sell electric vehicles. When there are not many firms in a market, each firm has a high market share and they have monopoly power. This would happen if each firm owns at least 25% market share. One impact of monopoly power is that monopolies charge high prices and have low output. The diagram below shows this, as they are profit maximisers so they will set a price of p1, and earn supernormal profit shown by the dotted rectangle.

Since electric vehicles reduce the negative externalities of fuel vehicles, and cause less harm to the environment, they could be deemed as a merit good. It would be a bad idea to have the price very high and the output very low in this case, as it is important for a healthier alternative to be accessible to all, as people need to drive in order to be productive or to look after or socialise with family and friends. This outcome of high prices and low quantity would cause another market failure of its own.

In evaluation, the monopoly power could also be hugely beneficial as it leads to an outcome where firms make supernormal profit. Supernormal profit can be used to invest and improve products, and consumers would therefore see dynamic efficiency, and better products in the long run. For example, if Apple did not make profit on the iphone 5, then the iphone 15 may not be as good as it currently is. Also, it may be that firms have monopoly power in the short run but if barriers to entry are low, this would be more of a monopolistically competitive market structure, which has its own benefits. In the long run, each firm's demand curve would shift to the left as other firms would see the supernormal profit firms like Tesla are making and enter the market. We are seeing that most major car manufacturers are planning to build fully electric cars, even traditional fuel car makers such as BMW and Porsche.

In conclusion, the switch to electric vehicles is an example of creative innovation and this can have many benefits. It reduces the quantity consumed of fuel vehicles so this reduces negative externalities and it leads to a new and interesting market for electric vehicles. The outcome of the new market structure depends on the barriers to entry. I would expect high market share and monopoly power in the short run and a monopolistic competition in the long run when new firms enter.