Assess the view that the increasing scarcity of sand is a problem best solved by market forces, rather than through government intervention (25 marks)

Intro:

- the market mechanism can solve it by itself (no)

- there is a market failure (yes)

- one example of a gov intervention e.g. tax (yes)

- government failure (no)

p2: market mechanism has 4 functions: rationing, incentive, signalling, allocating. e.g. if the sand is running out, sand will be RATIONED because the price will go up. it is an overnight solution but over time, a high price SIGNALS that there is not enough sand available, and this INCENTIVISES 1. people should figure out how to supply sand, or 2. start looking for substitutes.

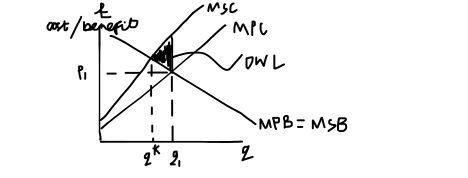

p1: negative externality in production. define. diagram. mention the fact there is an under-production visible on that diagram in the free market. market is not working. partial market failure. gov have to intervene

p3: e.g. we can tax this. draw the tax diagram. supply shifts left. evaluate the tax by mentioning elasticity and tax revenue and burden.

p4: go into more detail about gov failure e.g. inelastic so tax doesn't work. what do we even do with the revenue. imperfect info. unintended consequences.

the idea that there is a possible market failure, and if so, gov needs to intervene. but there might not be a big enough market failure/ market mechanism works well/ government intervention vs government failure.

Without government intervention, we have a free market for sand. The price mechanism has three main functions. It enables goods to be allocated to the most willing and able customers due to prices, and it signals where resources are required and where they are not. Lastly, it rations resources as excess demand (shortage) leads to a rise in prices. This is important in the sand market because even if sand is about to run out, prices can rise meaning that sand can be rationed and it won’t run out. Similarly, this can be a signal for more suppliers to enter the market. This means that the government does not to regulate the market and it also means that those who are willing and able to buy a good will always get the good. This saves the government time and resources and also reduces the likelihood of government failure. This can occur when government intervention leads to unintended consequences. Lastly, free markets are meant to be efficient. This is because producer and consumer surplus is maximised. Everyone is happy and markets automatically adjust to challenges. Consumer surplus is the difference between the price paid and the maximum price a consumer would have been willing to pay, and producer surplus is the difference between the price the producer gets and the minimum price they would have sold for.

In evaluation, this is not necessarily true. Free markets are not always allocatively efficient because they do not account for externalities. They can have negative externalities. Externalities occur when the market mechanism has a cost or benefit on a third party outside the transaction that is not accounted for. In this case, sand has to be transported and this causes a lot of pollution. Similarly, land is depleted so future generations lose out. “Sand miners have erased over 20 islands since 2005” (Line 10, Extract B).

This leads me to argue that government intervention is necessary to correct the market failure. There are two main types or market failure; an environmental market failure in the form of the tragedy of the commons, as well as a negative externality in production. Tragedy of the commons is when a good is consumed rationally by each consumer but that leads to an outcome which is detrimental to society overall. This can eventually lead to the good news longer being available which is a missing market, a complete market failure. The other type of market failure is negative externality. This is when the production of the good itself needs to negative impact on third-party. But example, the producer only thinks about the cost to produce the same however producing sound good to you nice pollution and other things which can affect people outside the market mechanism (buyer and seller).

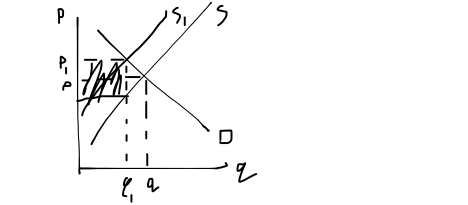

Firstly, a tax can be used to minimise the consumption of sand to q* which is the socially optimum level. This will help reduce the quantity of sand people and companies are using and hence reduce the negative impacts such as pollution and depletion. A tax is a cost of production imposed on a good or service. Taxes cause supply to decrease and hence price to increase. This leads to the marginal private cost graph shifting upwards and allowing us to attain the socially optimal quantity. Hence, there are no longer any externalities.

This diagram shows the tax causing supply to increase and hence quantity falling from q to q1. A free-market economist would evaluate by saying that government intervention can lead to government failure. For example, we illustrated that the socially optimal level of sand is q* however it is virtually impossible for the government to know this exact amount, so therefore they won’t know how much to tax the sand. This tax can then result in unintended consequences due to the imperfect information the government has. Extract B, Line 20 says “surging demand has sparked a lucrative illegal trade”. If the government tax the sand too highly, this can lead to the price rising too much. With people eager to buy sand to build housing and infrastructure (Extract A, Figure 2: demand rising to 406m tons by 2025), this can lead to a black market emerging whereby people mine sand without following the regulation and sell it for a cheaper price than official sellers. This will unintendedly lead to more market failures such as further depletion as well as a loss of tax revenue.

Overall, I would argue that government intervention is necessary to prevent the externalities associated with the free market solution however it is important that the government carefully consider the consequences of a poor government intervention. An accurate level of taxation, or a quota and permits to regulate the amount of sand each buyer can have would greatly reduce the scarcity of sand and improve its allocation and the fairness so that everyone can access sand in the market.

25-Mark Essay Plan for A-Level Economics

Intro:

- the market mechanism can solve it by itself (no)

- there is a market failure (yes)

- one example of a gov intervention e.g. tax (yes)

- government failure (no)

p2: market mechanism has 4 functions: rationing, incentive, signalling, allocating. e.g. if the sand is running out, sand will be RATIONED because the price will go up. it is an overnight solution but over time, a high price SIGNALS that there is not enough sand available, and this INCENTIVISES 1. people should figure out how to supply sand, or 2. start looking for substitutes.

p1: negative externality in production. define. diagram. mention the fact there is an under-production visible on that diagram in the free market. market is not working. partial market failure. gov have to intervene

p3: e.g. we can tax this. draw the tax diagram. supply shifts left. evaluate the tax by mentioning elasticity and tax revenue and burden.

p4: go into more detail about gov failure e.g. inelastic so tax doesn't work. what do we even do with the revenue. imperfect info. unintended consequences.

the idea that there is a possible market failure, and if so, gov needs to intervene. but there might not be a big enough market failure/ market mechanism works well/ government intervention vs government failure.