Indirect Tax | A-Level Economics Model Essay

In 2015 a report by Public Health England recommended the imposition of a 20% tax on the sale of soft drinks that contain high levels of sugar.

Evaluate the likely microeconomic effects of such a tax.

Market failure is when there is a misallocation of resources. Sugar is a demerit good as it has negative externalities in consumption. Negative externalities are costs that affect third parties, such as taxpayers. If there is a market failure, that is a good reason for governments to intervene. One example of a government intervention is an indirect tax.

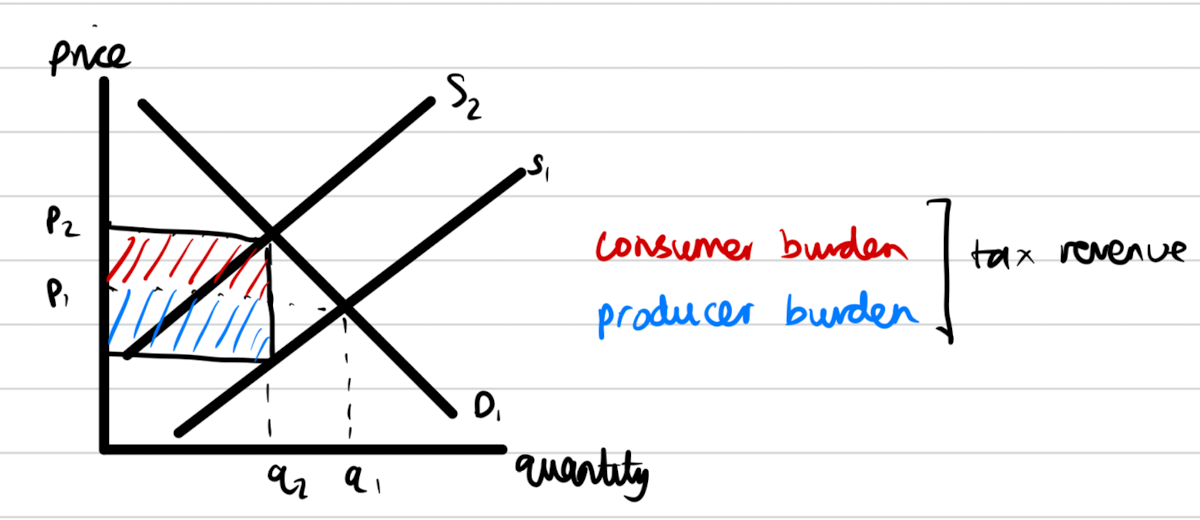

A tax is a cost of production that shifts supply to the left.

The diagram above shows that a tax shifts supply from S1 to S2. This causes price to go up from p1 to p2 and the quantity consumed to fall from q1 to q2. Causing the quantity to go down is important as sugar is over consumed as consumers and producers buy and sell sugar without realising the impact on the third parties. People who buy sugary drinks are more likely to fall ill, and they may have to visit the doctor more often or they may have unhealthy and unproductive lifestyles. This can prove to be a burden on family members, neighbours, or taxpayers. In the diagram, the rectangle shows the amount of tax paid in total to the government. The rectangles are roughly even, as consumers and producers share an equal burden.

I would evaluate this by questioning if quantity would fall as much as the diagram shows. This is because the diagram does not accurately reflect the fact that sugary drinks are inelastic in demand. If the government has imperfect information, they may make poor choices of intervention and this increases the risk of government failure, which is when the market failure does not get solved.

Price elasticity of demand is the percentage change in demand given an intial change in price. If demand is inelastic, it means that quantity demanded would not fall that much after a change in price. Sugary drinks are inelastic because they are somewhat addictives and they cost a small proportion of income, so even if prices rise after a 20% tax, demand may barely fall.

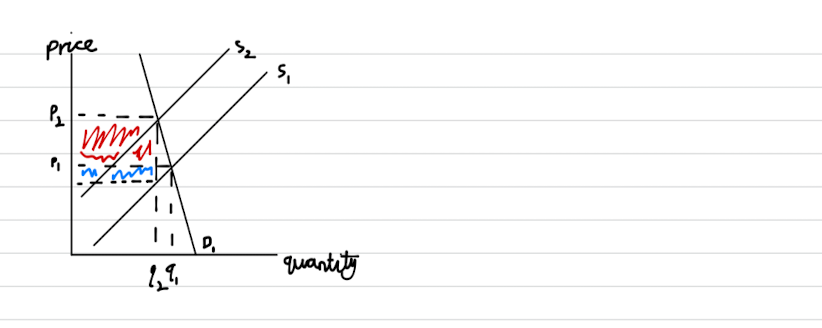

The diagram shows the effect of an indirect tax when it is applied to a good which is an inelastic demand curve. The effects are similar as the price goes up from p1 to p2 and quantity goes down from q1 to q2. However, the price goes up a lot and the quantity goes down a little bit. This is bad because it means the indirect tax is not going to solve the market failure, as quantity has to go down by enough in order to reduce the negative externalities on third parties from sugar. Another negative of taxing an inelastic good is that the consumer burden is much more than the producer burden. This is going to affect low income consumers more so therefore it would increase inequality. Although sugary drinks are bad for everyone, it is unfair if the tax affects poorer people more. There would be also not be enough incentive for higher income consumers to stop buying sugary drinks.

On the other hand, one benefit of the tax is that it generates a large amount of tax revenue which goes to the government. This could be used to fund public services such as health and education and police. But, it could also be used to further solve the market failure. For example, the money that is raised from a tax on sugary drinks could be used to subsidise healthy alternatives such as fresh fruit juice, or water bottles. Subsidies are payments that allow supply to shift to the right. If sugary drinks are the same price or cheaper than healthy drinks, it is far more unlikely that consumers change their consumption patterns.

In conclusion, it may be a good idea to tax sugary drinks but the government should consider the fact that sugary drinks are inelastic. They should expect to gain tax revenue and use this to plan other government interventions such as provision of information or subsidising healthy alternatives. Subsidising healthy alternatives would make substitutes cheaper and this may also make sugary drinks less inelastic.